CCI Surety, Inc. is a Managing General Underwriter licensed as an insurance agency under the laws of the State of Minnesota specializing only in the surety bond industry. Organized in 1999, the original purpose of this corporation was to provide working capital loans to contractors in conjunction with North American Construction Services, Inc., a nationwide contract surety fund control/escrow company. In the year 2000, the financing activities of CCI were transferred to Beacon Financial Acquisition Corporation, an affiliated company engaged in equipment leasing, sale-leaseback, working capital, and investment activities.

CCI Surety, Inc. has changed its emphasis to working with insurance companies and their agents in all 50 states, primarily in the field of Specialty Bonding. Many past events in the Surety Bond Industry, ranging from the collapse of major Surety companies to the restraint of capacity, have created a need for our service and expertise. CCI Surety has developed in-house underwriting authority up to $3,000,000 through years of experience. We are committed to providing non-standard bond options that do not rely on heavy collateral burdens on contractors.

In addition to our senior in-house underwriters, we have dedicated underwriters specializing in contractors working on projects $250,000 and under. This means that small, emerging and developing contractors receive as much attention as larger accounts. CCI Surety also has a dedicated commercial bond department handling license and permit, ERISA, court, fidelity, DMEPOS, and many other types of commercial and miscellaneous bonds.

CCI Facts:

- A-Rated and T-Listed Surety Companies

- Competitive Commissions

- Misc. Surety

- Trained Seasoned Staff

- Multiple Underwriting Offers

- Indemnity Only

- SBA Surety Bond Guarantee Program

- Funds Control

- Seed Money

- Third Party Indemnity

- Account Service

- Dedicated In-house Underwriters

- Prompt Feedback on initial Submission

- Provide path to bonding if possible

If you have any questions or need more information, don’t hesitate to contact us – Jim Dillenburg jdillenburg@ccisurety.com 866-317-3294

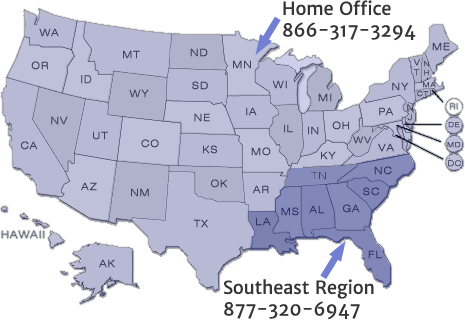

Our Home Office handles non-standard bond situations in Maine, Vermont, New Hampshire, Massachusetts, Connecticut, New York, Pennsylvania, New Jersey, Rhode Island, Delaware, Maryland, Virginia, West Virginia, Ohio, Kentucky, Tennessee, Arkansas, Texas, Oklahoma, Kansas, Missouri, Illinois, Indiana, Michigan, Wisconsin, Minnesota, Iowa, Nebraska, South Dakota, North Dakota, Montana, Wyoming, Colorado, Idaho, Oregon, Washington, Hawaii, Alaska, and Washington D.C.

Payment & Performance ★ Bid ★ ERISA ★ Motor Vehicle Dealer Bonds ★ BMC-84 ★ Wage & Welfare ★ License and Permit ★ Commercial ★ Contract ★ Miscellaneous

Please Note: We can always get started working on any bond application that you have already prepared for other markets. CCI Surety, Inc. specializes in hard to place contract bonds that may have previously been declined by other sureties. We use different kinds of tools which allow us the freedom to think outside the box with our underwriting strategy. We are able to get comfortable with difficult situations using escrow / funds control, SBA Surety Bond Guarantee program and working capital deposits as different options to get the bond approved. CCI also has a very successful Easy Start Program for contracts between $250,000 and $1,000,000 that may be obtained with a two page application plus any financial documents that are available. On commercial bond business we handle both standard and non standard business. Contract Bonds – Multiple Markets – Can Provide A+ rated bonds – $3M in-house authority, up to $15M from home office – Quick Turn around – No Agency Requirements SBA Backed Bonds – 2012 National SBA Bond Producer of the Year – Potential to approve bonds even with negative working capital – SBA Bond Program now covers bonds up to $6.5M and in some cases $10M Commercial Bonds – Standard and Non-Standard Bonds – Experienced staff specialized in handling Commercial Bond needs – License and Permit, Fidelity, ERISA, Business Services and Court Bonds – Miscellaneous Bonds